Foreign Contractor Tax – a special tax of Vietnam

- What is FCT?

- Tax

- The reason why FCT is important

- Examples when consulting on FTC

- I-GLOCAL also

supports FTC

related services

What is Foreign Contractor Tax?

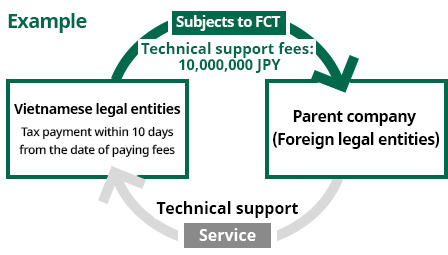

Foreign Contractor Tax or Foreign Contractor Withholding Tax –

abbreviated as FCT, FCWT, is a tax applied when foreign legal entities provide services to a Vietnamese legal entities.

In other words , it’s the tax that applies to the expenses payable by Vietnamese legal entity

(not the revenue/profit of the Vietnamese legal entity). The taxable party can be a foreign legal entity or a Vietnamese legal entity,

it’s depending on the provisions of the contract. However, taxpayer must be a Vietnamese legal entity.

- ※ Either party can bear the tax.

Tax

FCT includes 2 types of taxes – Value Added Tax (VAT) and Corporate Income Tax (CIT), each tax have difference

| Content | VAT (%) |

CIT (%) |

|---|---|---|

| Product trading with services, exporting on the spot | Tax Exemption | 1 |

| Construction, installation which does not include bidding for materials or machinery and equipment | 5 | 2 |

| Construction, installation which is including materials or machinery and equipment; transportation services, production | 3 | 2 |

| General services, equipment rental | 5 | 5 |

| Interest rate | Tax Exemption | 5 |

| Copyright fee | Tax Exemption | 10 |

| Copyright fee management services for the trademark use ; restaurant , hotel, casino management services | 5 | 10 |

| Securities transfer, reinsurance | Tax Exemption | 0.1 |

| Derivative financial products | Tax Exemption | 2 |

The reason why FCT

is important

FCT is only in Vietnam, so the regulations are difficult to explain.

However, FCT has a big effect on Vietnamese businesses that have transactions with foreign partners, so this tax is quite important.

- Wide range of taxable objects

- Contract signed with foreign organization, individual.

- Many points need to attention on the way specified in the contract

- The taxable party is definite in the contract

- Declare and pay tax within 10 days from the date of payment

- Easily pointed out as a violation when tax inspection in Vietnam

Examples when consulting

on Foreign Contractor Tax

We provide a wide range of consultations from basic questions to specific cases.

- What is FCT?

- Do all transactions need to be reviewed to check which transactions are subject to contractor tax?

- Until now we have not filed the FCT, is there any retrospective tax payment during tax inspection?

- Will tax amount change based on the ways on writing the contract?

- How is the FCT different from the Japanese withholding tax?

- If already taxed in Japan, is it possible to avoid being taxed according to the regulation of the agreement to avoid double taxation? Is it possible to deduct taxes paid abroad?

- Is it true that when sending people to work under a technical support contract, we need to pay both FCT and PIT?

- FCT is a tax applied on services, so is it taxable when importing equipment items?

- Is FCT applicable in international trade terms?

I-GLOCAL also supports

Foreign Contractor Tax

related services

I-GLOCAL also has a lot of knowledge and practical experience in Foreign Contractor Tax.

- I-GLOCAL is providing Tax – Accounting services for over 1,000 Japanese enterprises currently, we solved problems with a high expertise.

Based on practical experiences, I-GLOCAL is confident to support enterprises invest in Vietnam

by the most suitable way to help businesses avoid potential risks or unnecessary taxes.

With a variety of support forms, we will try to support companies to expand investment to Vietnam - Consulting on Foreign Contractor Tax is

conducted any time through Annual Consulting Contract!

FCT related reports

- I-GLOCAL ・Vietnam Report

~Accounting and Tax - Vietnam Foreign Contractor Tax (FCT) Overview and Practical Considerations

- I-GLOCAL ・Vietnam Report

~Accounting and Tax - Foreign Contractor Tax and Incoterms in Vietnam

- I-GLOCAL ・Vietnam Report

~Accounting and Tax - Main transactions subject to foreign contractor tax in Japanese companies in Vietnam