- We can support to analysis transfer pricing risk and

prepare documentation based on Vietnamese practice

Transfer pricing

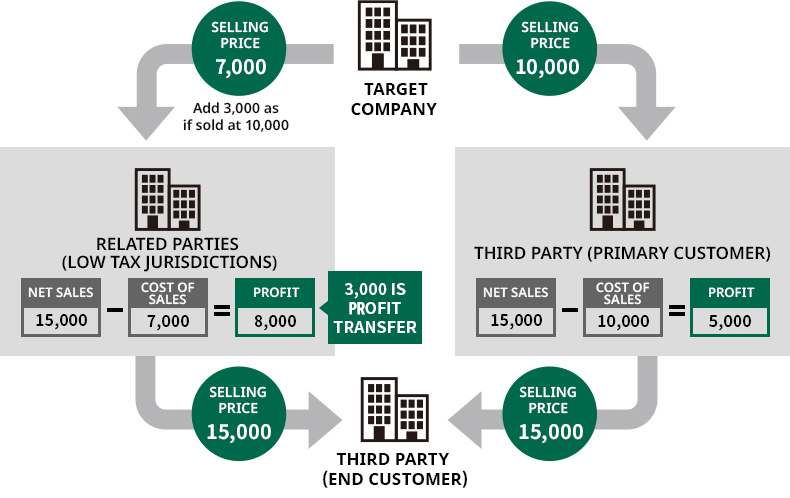

The difference in transaction prices with related parties (group companies, major shareholders, etc.) compared to third-party transactions is recognized as international tax avoidance.

For example, since the differences of the corporate tax rate between Japan and Vietnam, if there are the products which are made by Vietnamese subsidiary and sold to the Japanese parent company, then sold to external customers, the profit (margin) of the Vietnamese subsidiary and the Japanese parent company will be manipulated by the internal sales prices within the company group.

To prevent companies making large profits in countries with low corporate tax rates and intentionally lowering the tax amount for the entire group, global tax regulations (transfer pricing taxation) have been put in place, mainly by the OECD.

Transfer pricing tax risk

Vietnam is not a member of the OECD, but basically applies the OECD guidelines for transfer pricing. Vietnamese companies satisfied the condition of a certain amount standard in the current regulation (until May 2023) – Decree132/2020/ND-CP are required to prepare transfer pricing documents (Local File – LF, Master File – MF, Country-By-Country Report (CbCR)).

In tax inspection, there is an increasing trend of risk of pointing out transfer pricing, and if the companies do not prepare transfer pricing documents despite the obligation to prepare them, there is a risk that these companies will be at risk of being noticed by tax office and haveing a large amount of tax arrears.

Notices and risks associated with the obligation to prepare transfer pricing documentation

- There are cases that Vietnamese subsidiary is subject to document preparation even though Japanese parent company has no obligation to to document preparation.

- Reputational risk is also a concern if the companies have no appropriate tax compliance.

(Even if it is an additional tax arrears due to transfer pricing, there is a possibility that it will be reported as “tax evasion at overseas subsidiaries”)

It is necessary to confirm the documentation obligations

of Vietnamese subsidiary and the transfer pricing policy between companies

in the group before the tax inspection.

Our service

I-GLOCAL has a transfer pricing team in both Hanoi and Ho Chi Minh City. We support more than 100 transfer pricing documents annually in Vietnam, mainly for Japanese companies.

We will promote practical transfer pricing risk assessment and documentation, such as points to note in documentation and points that are likely to be focused on in tax inspection.

Main supporting services

- Prepare transfer pricing documents

- Support in transfer pricing tax inspection (mainly support for clients that we have prepared transfer pricing documents)

- Perform Benchmarking research (calculate the range of profit margins of comparable companies and use them to set future profit margins)