Points to note when dismissing employees due to changes in structure, technology, or economic reasons

2023/09/22

- US CPA

- Masaya Sakai

Introduction

When dismissing an employee due to structural, technological changes or economic reasons, the employer, in addition to its normal obligations when terminating the employee’s labor contract, must draw up a worker employment plan and provide the employee with the allowance must be paid. Therefore, we have summarized the following points that companies should keep in mind when dismissing employees for such reasons.

I. Conditions under which a company may dismiss employees due to structural, technological changes or economic reasons

According to the provisions of the Labor Law, the following cases are considered structural, technological changes or economic reasons:

| If it is considered a change in structure or technology | If it is considered to be for economic reasons |

| (1) Changes in labor organization structure and labor reorganization (2) Changes in the product or structure of the product (3) Changes in production and management regulations, technology, machinery, and equipment according to the user’s production and management industry. |

A large number of workers may lose their jobs due to economic reasons. (1) Economic depression or decline (2) In the case of economic restructuring, implementation of national policies (3) Implementation of international commitments |

If any of the above cases affect the employment of an employee (two or more), the employer has the following obligations:

| Duty | Points to remember |

| (1) A worker utilization plan must be formulated and implemented. In addition, when assigning workers to new tasks, priority training is given to workers for continued use. | The exchange of opinions with the trade union executive committee is a form of dialogue as stipulated in Article 63 (2) c, Article 64 (1) of the Labor Law 2019 and Article 41 (1) of Decree No. 145/2020/ND-CP. must be carried out. |

| (2) If the employer is unable to resolve the employment problem and has to dismiss the worker, it must pay unemployment benefits in accordance with Article 47 of the Labor Law. | In this case, in a workplace where there is a worker representative organization of which the worker is a member, the worker may be dismissed only after exchanging opinions with the organization. It will also notify the provincial People’s Committee and workers 30 days in advance. |

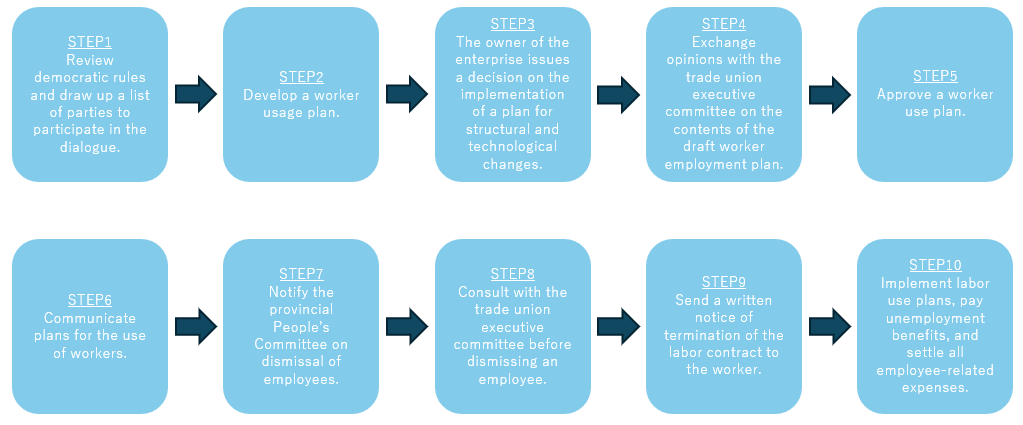

II. Procedures for dismissing employees due to structural, technological changes or economic reasons

When dismissing employees due to structural, technological changes or economic reasons, enterprises must carry out procedures in accordance with the provisions of the 2019 Labor Law and Decree No. 145/2020/ND-CP. The details are summarized below.

Step 1: Review the democratic rules in your workplace and create a list of company and employee representatives who will participate in the dialogue.

The number and composition of dialogue participants are specified in Article 38 of Decree No. 145/2020/ND-CP as follows:

| User | Employee |

| Based on the conditions of production and business and the organisation of work, the employer shall determine the number and composition of the representatives taking part in the dialogue and shall lay down these in the form of democratic rules. Of these, at least three participants, including a legal representative, must be secured. In addition, based on Decree No. 48 of Government Decree 145/2020/ND-CP, attention should be paid to formulating and promulgating democratic regulations in the workplace. |

The composition will be determined based on production and business conditions, number of workers and gender equality, but the number of participants must be as follows: – Where fewer than 50 workers are used: minimum of 3 – For groups of 50 to 150 people: minimum 4 to 8 people – For groups of 150 to 300 people: minimum 9 to 13 people – For groups of 300 to 500 people: minimum 14 to 18 people – For 500 to 1,000 people: minimum 19 to 23 people – For groups of 1,000 or more: minimum 24 people |

Companies should establish a roster of representatives to participate in the dialogue between employers and employees in accordance with the above. This list will be updated regularly, at least every two years, and published in the workplace. If any representative is unable to participate during the dialogue period, the employer or the employee representative organization shall consider and decide on replacement or additional representatives.

Step 2: Develop a workforce utilization plan.

First, the labor utilization plan must include the following:

– The number and list of workers who will continue to be employed, those who will be retrained for continued employment, and those who will transition to part-time work

– Number and list of workers who will retire

– The number and list of workers whose employment contracts must be terminated

– The rights and obligations of employers, employees and other relevant parties in the implementation of employee use plans

– Measures and financial resources to ensure the implementation of the plan

Next, based on the classified list of employees, in accordance with the provisions of the Labor Law, the employer prepares a budget to implement the plan. Of these, one of the largest expenses that employers pay to employees is unemployment benefits. The amount of unemployment benefits and the method of calculation are set out as follows:

Amount of payment: Workers will be paid unemployment benefits equivalent to one month’s salary for every year of service.

Method of calculation:

Unemployment benefits = working period for calculating unemployment benefits × wage amount for calculating unemployment benefits

Note:

– If the benefit amount is less than two months’ salary, the benefit amount will be rounded up to two months’ salary.

– Period of employment for benefit calculation = total period of actual employment – period of unemployment insurance coverage – period of employment for which previous unemployment benefits were paid by the employer (if any)

– The period of employment for the purpose of calculating benefits is calculated in years (12 months)

– If the period is between 1 month and 6 months, it will be rounded up to 6 months.

– If the period is more than 6 months but less than 12 months, round it up to 1 year.

Typically, companies pay benefits for the period during which you are not covered by unemployment insurance. Probationary periods, sick leave, and maternity leave (if any) are periods during which you are not covered by unemployment insurance.

In practice, the procedures for terminating an employee’s employment contract due to structural or technological changes or economic reasons are very complex and are often entrusted to lawyers or consulting firms. Therefore, employers need to include such consulting costs in their budget in addition to unemployment benefits.

Step 3: The owner of the enterprise issues a decision on the implementation of the plan of structural and technological changes (in case of structural and technological changes).

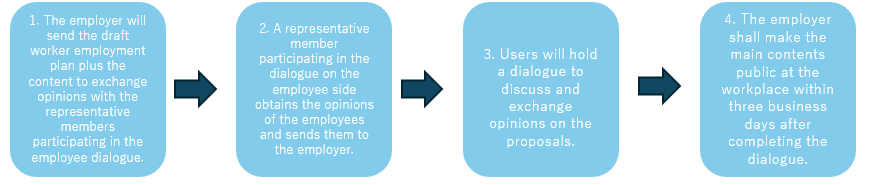

Step 4: Exchange opinions with the trade union executive committee on the contents of the draft labor use plan.

When formulating plans for the use of workers, employers must exchange views with worker representative organizations at workplaces where such organizations exist. The procedure for exchanging opinions is as follows:

According to the Labor Law, labor utilization plans do not need to be approved by the trade union executive committee, but any opposition from the trade union executive committee could lead to conflict with employees. This step should be undertaken with care as the employee departure process may be lengthy.

Step 5: Approve the Worker Utilization Plan.

Step 6: Publish your Workforce Utilization Plan.

Step 7: Notify the provincial People’s Committee about dismissing the employee.

Before dismissing an employee, an employer is obliged to give 30 days’ notice to the provincial people’s committee. The law does not specify the form in which to notify the provincial people’s committee of an employee’s resignation. However, to best comply with the law, we recommend that you notify in writing and provide your labor use plan and any other relevant documents, such as:

Minutes of conversations when formulating labor use plans

– Approval of the labor plan by the general meeting of owners and employees

– Minutes of the discussion before dismissing an employee

– Guidance from the national authority with authority over labor (if any)

Step 8: Consult with the trade union executive committee before dismissing employees.

Step 9: Send the worker a written notice of termination.

Step 10: Implement the labor utilization plan, pay unemployment benefits, and settle employee-related expenses.

Within 14 working days from the date of termination of the employment contract, the employer shall:

1) Settle all of the following items to which employees are entitled:

– Pay employees adequately.

– Pay salary for unused annual paid leave.

-Pay unemployment benefits.

– Settle unpaid allowances etc. to other employees.

② Check the period for which social insurance and unemployment insurance fees are paid. Additionally, if you have retained any relevant employee documents, you must return them to the employee. If an employee requests it, copies of each document relevant to the employee’s work process shall be provided.

Conclusion

This article summarizes points to keep in mind when dismissing employees due to structural or technological changes or economic reasons. In our experience, it takes 6-12 months to complete all the necessary steps above. Companies in this situation should use this report to plan and implement labor plans that comply with laws and regulations, ensure the rights of employees, and ensure the smooth implementation of the necessary procedures.

Reference Laws and Regulations

・2019 Labor Law

・Decree No. 145/2020/ND-CP

That’s all

*This article was translated by Yarakuzen.